Understanding Loan Grades in Peer-to-Peer Lending

Get ready to explore peer-to-peer lending! This innovative approach connects you directly with investors, giving you more freedom in obtaining loans. It grants you direct access to loans and potential returns like never before.

At the heart of this dynamic landscape is the concept of loan grades, which act as crucial indicators of both risk and reward potential.

This guide clearly explains what loan grades are, how they are assigned, and the various factors that influence them.

It delves into the inherent risks and provides pragmatic advice for investing wisely across different loan grades.

Whether you re just stepping into the world of peer-to-peer lending or seeking to refine your investment strategy, this information equips you to navigate this financial frontier with confidence.

Contents

Key Takeaways:

Loan grades are a key factor in peer-to-peer lending, representing the creditworthiness of borrowers and the expected risk and return for investors. Factors such as credit score, income, and debt-to-income ratio (which measures how much of your income goes to paying debts) are used to determine loan grades, with higher grades indicating lower risk and potentially lower returns. Investors should diversify their portfolios by investing in loans across different grades to minimize risk and maximize potential returns in peer-to-peer lending.

What is Peer-to-Peer Lending?

Peer-to-Peer (P2P) lending is a game-changing financial model that connects you directly with investors through online platforms, sidestepping traditional financial institutions. This approach opens up a more flexible pathway for obtaining personal loans, allowing you to access funds with varying credit requirements.

Investors can pursue attractive returns on their capital. Platforms like LendingClub, Prosper, and Upstart exemplify this model, offering a streamlined online application process designed to align with your unique investment preferences and risk tolerance.

In this innovative setup, you can submit loan requests outlining the amount you need and the purpose behind it whether for personal projects, debt consolidation, or home improvements.

Meanwhile, investors sift through these requests, handpicking loans based on their desired interest rates and risk evaluations. This direct connection can lead to lower interest rates for you and higher potential returns for investors when compared to the traditional methods employed by banks.

The transparency and speed of processing enhance your experience, making P2P lending an appealing alternative for those seeking financial relief or new investment opportunities.

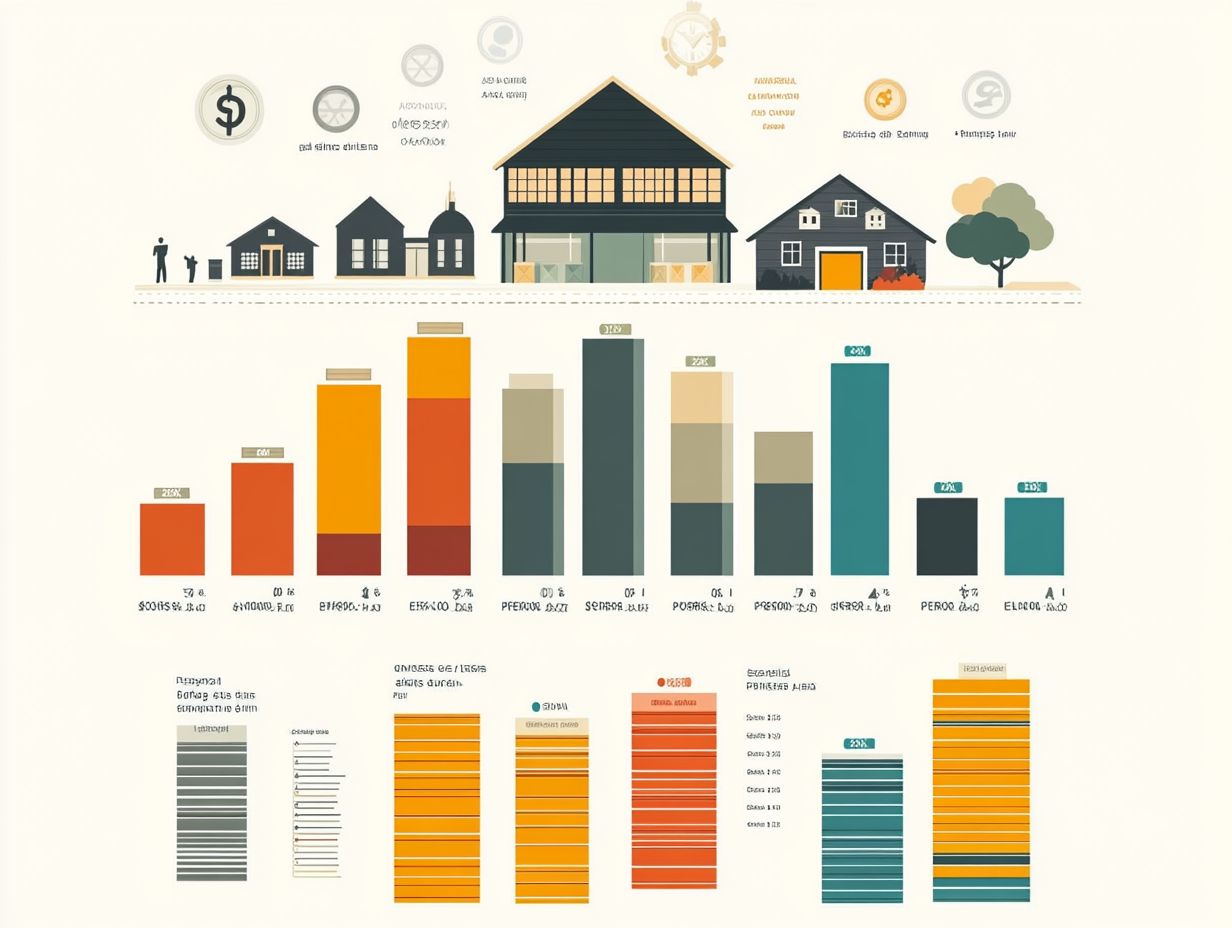

Loan Grades Explained

Loan grades serve as essential classifications that enable you, as a borrower or investor, to evaluate the risk and potential returns linked to a loan.

By analyzing factors such as your credit score, financial history, and the interest rates involved, lending platforms assign grades that empower you to make informed choices regarding loan listings.

This grading system is crucial in the realm of P2P lending, fostering clearer expectations for monthly payments and investment results.

What are Loan Grades?

Loan grades serve as a systematic framework for categorizing the risk associated with various borrowers in the lending landscape. This allows you, as an investor, to make informed decisions grounded in these assessments.

Each grade indicates the likelihood of loan repayment and directly impacts interest rates, making them crucial for crafting an effective investment strategy.

Typically, loan grades range from A to D or even F, with an ‘A’ grade signaling high creditworthiness, which often translates to lower interest rates. On the flip side, lower grades denote a higher perceived risk, which usually results in increased rates as lenders aim to mitigate potential losses.

This grading system not only aids you in evaluating a borrower’s ability to repay but also significantly influences investor confidence. Institutional investors, in particular, rely heavily on these grades to assess the safety of their investments, shaping their willingness to fund various loans.

How are Loan Grades Assigned?

Loan grades are assigned based on various factors, primarily your credit requirements and score. These act as indicators of your ability to repay the loan.

Financial institutions use algorithms to analyze credit history, income, and debts. This determines the grade for your loan application.

Evaluations like the ratio of your debts to your income and employment stability are crucial. Each loan grade indicates the likelihood of default, helping lenders make informed decisions.

A higher loan grade usually means lower interest rates. In contrast, lower grades may lead to stricter terms.

Factors that Affect Loan Grades

Several critical factors shape loan grades, affecting risk perception in P2P lending.

Your credit score is central to this assessment. Various financial indicators also play a significant role in evaluating your creditworthiness.

Credit Score and History

Your credit score and history are essential in determining loan grades. They provide a clear picture of your financial reliability.

A higher score typically leads to lower interest rates. Conversely, a poor credit history limits your access to loans.

If your score is above 740, you’re often seen as a prime candidate. You could enjoy interest rates as low as 3% on mortgages.

Those with scores below 620 may face rates above 7%, making repayments more challenging.

Lenders scrutinize credit history for patterns like late payments. Maintaining a strong credit profile is vital for securing funds and favorable terms.

Income and Debt-to-Income Ratio

Your income level and the ratio of your debts to your income are crucial in determining loan grades. They reflect your ability to handle additional debt responsibly.

Lenders examine these alongside your credit history. A higher income suggests a stronger repayment capacity.

Creditors use these indicators to categorize loan applications. Managing your income and debts can greatly improve your chances of securing favorable options.

Understanding the Risks of Different Loan Grades

Understanding the risks of various loan grades is essential for investors in the P2P lending market.

Each grade has its unique default rates and expected returns. Evaluating these factors helps align your investment choices with your risk tolerance.

Default Rates and Expected Returns

Default rates and expected returns are essential indicators for you as an investor. They help you evaluate the feasibility of different loan grades in peer-to-peer (P2P) lending.

Higher-risk loans usually have higher default rates. However, they also offer the chance for greater expected returns, so you need to consider your risk appetite carefully.

As you explore individual loan offerings, remember that the balance of high yields comes with the risk of losing your principal.

Loans graded C or D might promise impressive returns, but they carry significant default risks. You ll need to look at historical data and current economic conditions to assess borrower reliability.

By understanding these dynamics, you empower yourself to make informed decisions that align with your financial goals and risk tolerance.

Tips for Investing in Different Loan Grades

Investing in various loan grades requires careful planning. You must understand the risks and rewards involved.

To refine your strategies, consider diversifying across different loan grades. This approach can reduce risks and help you enjoy attractive returns.

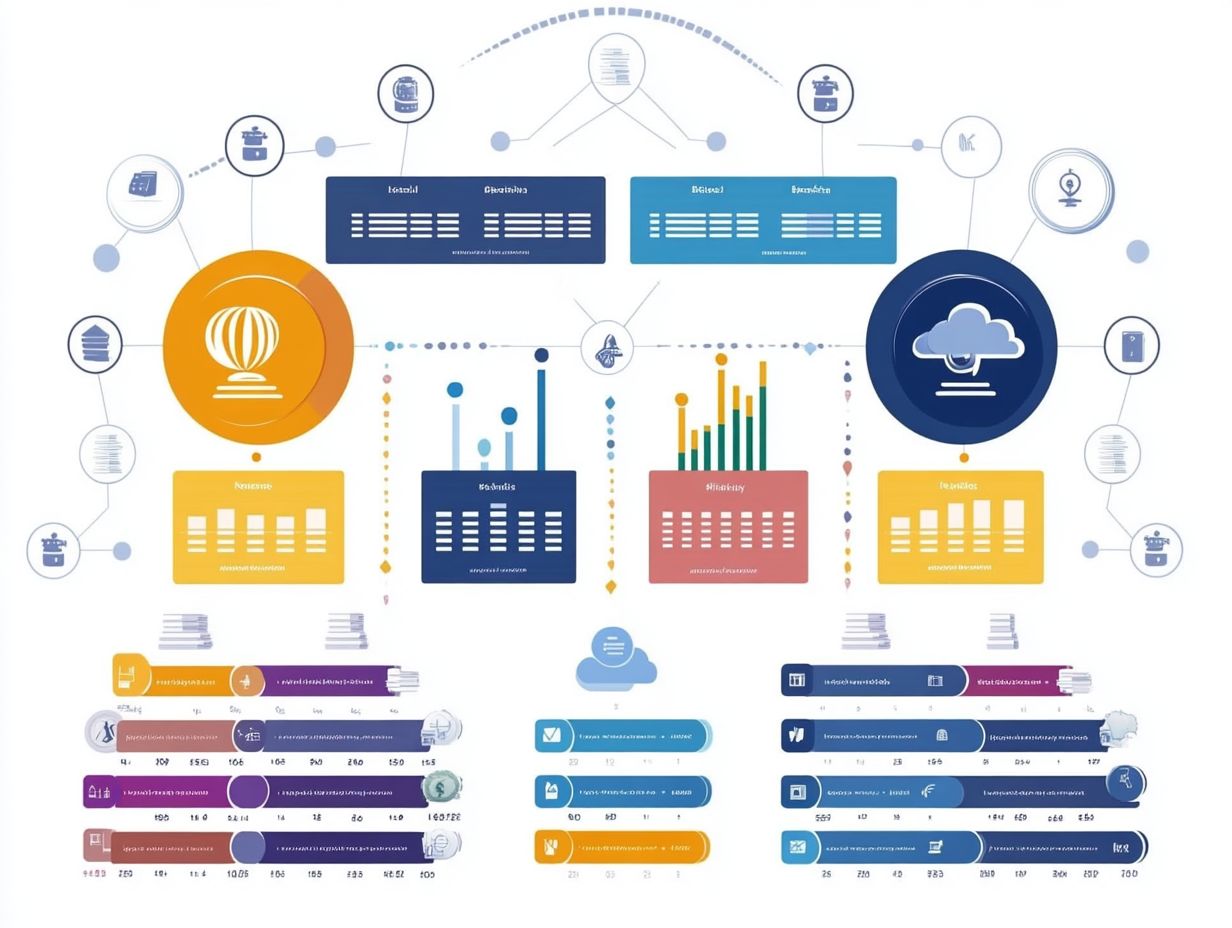

Diversification and Portfolio Strategy

Diversification is an essential element of your successful investment strategy in P2P lending. It helps you manage risk while maximizing the potential for returns across various loan grades.

By spreading your investments across different loan listings, you can build a balanced portfolio that adapts more effectively to fluctuations in default rates and economic conditions. This approach reduces the impact of a single underperforming asset and enhances your overall resilience.

Incorporating a mix of loans from various risk categories, including prime and subprime borrowers, strategically positions your portfolio for more stable returns. Diversification gives you the power to capitalize on small-scale economic changes and borrower behaviors, making it easier to navigate market volatility.

A well-diversified P2P lending portfolio empowers you to seize exciting opportunities today while weathering uncertainties in the lending landscape.

Frequently Asked Questions

What are loan grades in peer-to-peer lending?

Loan grades in peer-to-peer lending are a rating system used to classify the risk level of a loan. They are typically assigned by the platform or marketplace and are based on the borrower’s creditworthiness, financial history, and other factors.

How are loan grades determined?

Loan grades are determined by evaluating factors such as the borrower’s credit score, income, debt-to-income ratio, employment history, and the purpose of the loan. Generally, a higher grade indicates a lower risk of default for the loan.

What is the significance of loan grades in peer-to-peer lending?

Loan grades help investors make informed decisions about which loans to fund. Higher-grade loans typically offer lower interest rates and are considered less risky, while lower-grade loans may have higher interest rates and greater chances of default.

Can loan grades change over time?

Yes, loan grades can change, particularly if the borrower’s financial situation shifts. If a borrower’s credit score improves, their loan grade may also improve, and vice versa if they face financial difficulties.

What happens if a borrower’s loan grade changes after the loan is funded?

A change in a borrower’s loan grade after funding may not affect current investors, but new investors will consider the updated grade. It is important to track changes in loan grades to assess your investment risk.

Are loan grades the only factor to consider when investing in peer-to-peer lending?

No, loan grades are not the only factor to consider. Other important considerations include the purpose of the loan, the borrower’s financial history, and the overall economic climate. It is essential to conduct thorough research and diversify your investments to minimize risk.

Explore more about P2P lending and start building your portfolio today!