Understanding the Risks of Art Investments

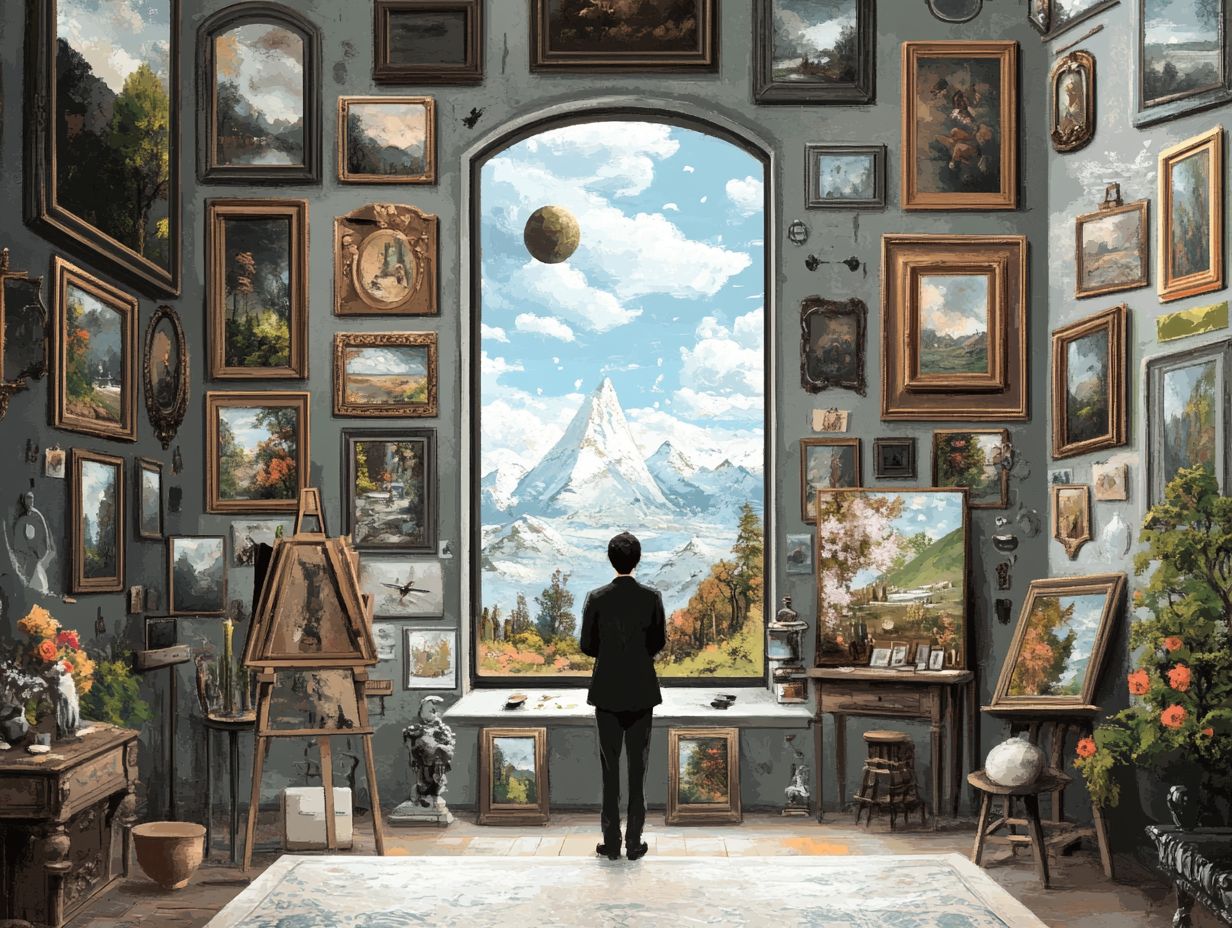

Art investment offers a compelling avenue to diversify your portfolio, but it’s not without its complexities.

As you explore this vibrant realm, it s crucial to grasp the inherent risks, ranging from market volatility to authenticity issues. This guide will help you discover key factors you must know before immersing yourself, such as maintenance costs and expert advice.

By the conclusion, you’ll be well-prepared to make informed decisions in this fascinating investment landscape. Ready to dive into art investment? Let s get started!

Contents

- Key Takeaways:

- What is Art Investment?

- Risks Involved in Art Investments

- Factors to Consider Before Investing in Art

- Your Top Questions About Art Investment Risks Answered!

- What is the meaning of understanding the risks of art investments?

- What are some risks associated with art investments?

- How can one determine the risks of investing in a particular artwork?

- Is investing in art a low-risk or high-risk venture?

- Are there any ways to mitigate the risks of art investments?

- What are some resources for understanding the risks of art investments?

Key Takeaways:

- Art investments carry significant risks, such as market fluctuations and authenticity issues.

- Consider market trends and get expert opinions before investing.

- Always do your homework to make informed decisions and avoid scams.

What is Art Investment?

Art investment involves acquiring artworks with the anticipation that their value will increase over time. It serves as a strategic pillar of wealth management for wealthy investors like you.

The art market is a vibrant landscape, influenced by elements such as prevailing art trends, prestigious auction houses, and exclusive private galleries. All these play a crucial role in determining the worth of fine art.

As you delve into various investment strategies, you might find yourself drawn to contemporary works from celebrated artists like Mark Rothko, Vincent van Gogh, and Banksy. This approach allows you to diversify your portfolio while skillfully navigating the intricacies of art authenticity and valuation.

Risks Involved in Art Investments

Investing in art carries inherent risks, which can significantly influence your financial performance and investment goals. It’s important to recognize these factors, much like understanding the risks of cryptocurrency investment, especially given the potential for dramatic market fluctuations.

As you consider entering this realm, it’s essential to weigh various investment risks, such as issues of authenticity, price volatility, and maintenance costs. Each of these factors can easily erode the anticipated appreciation in value of fine art.

Understanding how art is evaluated helps reduce risks and craft a robust investment strategy.

Market Volatility and Uncertainty

The art market is marked by significant volatility and uncertainty, heavily influenced by external economic factors, evolving art trends, and shifts in consumer behaviors.

The fluctuating art prices you encounter stem from various market conditions driven by demand from traditional auction houses like Sotheby’s and Christie’s, as well as emerging platforms. Understanding these dynamics is essential for anyone looking to invest in art.

Take, for example, the 2008 financial crisis, when art prices plummeted sharply, with some contemporary artists experiencing value reductions of up to 30%. However, following the recovery, the market rebounded spectacularly, as evidenced by the record-breaking sale of a Basquiat painting for an astonishing $110.5 million in 2017.

These price fluctuations underscore how dramatically market perceptions can shift based on economic indicators. Wealthy investors often find themselves reassessing their portfolios during economic downturns, viewing art as a potential hedge against instability. Therefore, staying informed about these trends is crucial for making strategic investment decisions.

Authenticity and Fraud

The authenticity of artworks is a paramount concern in art investment. It carries significant implications for both the valuation and resale potential of pieces acquired from auction houses or private galleries.

With the surge in art fraud cases, scrutiny around art evaluation processes has intensified. It is essential to verify the authenticity of artworks before committing substantial financial resources.

Take, for instance, the infamous Wolfgang Beltracchi scandal. Even seasoned collectors were duped by forgeries, highlighting the severe consequences of overlooking this crucial aspect. Fraud not only erodes trust in art markets but can also result in devastating financial losses for unsuspecting investors.

To successfully navigate this intricate landscape, prioritizing due diligence is key. Don t miss out! Always seek history of ownership documentation, engage reputable appraisers, and leverage scientific methods like infrared scanning (a technique to see beneath the surface of the artwork) or pigment analysis (testing the materials used in the artwork) to authenticate the pieces you’re considering.

Investing time in thorough research and seeking expert opinions can greatly enhance your chances of acquiring genuine artworks. Start your research today to protect your investments!

Maintenance and Storage Costs

Maintenance and storage costs can have a profound impact on the overall financial performance of your art investments. They often represent a crucial yet frequently overlooked aspect of the process.

Proper care and secure storage are essential for preserving the value of your fine art. This significantly influences sales and investment strategies over time.

These costs encompass a diverse array of considerations, including:

- Insurance premiums that shield against theft or damage.

- Restoration expenses that ensure your artwork remains in pristine condition.

- Climate control measures designed to mitigate risks associated with humidity and temperature fluctuations.

For you as a collector, grasping how these ongoing expenses affect your net returns is vital. Without effective management, they can chip away at profits tied to appreciating art pieces.

Implementing strategies such as regular evaluations, selecting suitable insurance plans, and investing in optimal storage solutions can help minimize these expenditures while maximizing your overall profitability.

Factors to Consider Before Investing in Art

Before you plunge into the world of art investment, it s essential to consider several critical factors that can significantly influence your success in this unique market.

Pay close attention to current art market trends and effective investment strategies. Evaluating the art landscape, seeking expert insights, and grasping the principles of diversification will enable you to make informed decisions that align with your personal investment objectives.

Art Market Trends and Analysis

Understanding art market trends is essential for you as an investor. It helps navigate the intricacies of art valuation and craft effective investment strategies specifically tailored to contemporary art.

Trends can shift rapidly, influenced by emerging artists, auction results, and evolving consumer preferences. Therefore, market analysis is crucial for informed art investment decisions.

Consider the rise of digital art and NFTs. This phenomenon has captivated new generations of collectors, illustrating how technology can redefine traditional notions of ownership and authenticity.

Emerging voices from underrepresented demographics are gaining traction, prompting you to reassess your collection in light of these shifts.

Recognizing the role of social media platforms in elevating emerging artists can provide you with invaluable insights into market dynamics. Grasping these evolving trends sharpens your ability to evaluate artworks and positions you to seize novel opportunities within a transforming marketplace.

Diversificaci n y Gesti n de Riesgos

Diversification is a cornerstone of smart investment strategies. It is especially important for high-net-worth individuals who want to reduce risks in art investments.

Spread your investments across different types of art, like contemporary pieces and established classics. This can boost your financial performance and lower your exposure to market changes.

This approach allows you to take advantage of varying market trends, providing a cushion against potential downturns in specific segments.

For instance, while contemporary art may fluctuate in popularity, classical pieces often retain their value, offering stability. Consider allocating funds to art-focused mutual funds or private collections that include a diverse range of styles, periods, and artists.

Diversifying your investments can balance risks and open the door to exciting returns across various economic climates. Ultimately, this leads to more robust financial outcomes.

Expert Opinions and Due Diligence

Seeking expert opinions and conducting thorough due diligence are essential steps for investors in the art market. This helps navigate the complexities of art evaluation and reduce potential investment risks.

Engaging with art advisors, appraisers, and reputable auction houses can provide valuable insights into the authenticity and value of artworks.

As you explore this intricate world, build a network of knowledgeable specialists who can offer tailored advice based on your unique objectives. Look for experts with a proven track record and relevant certifications in the art industry.

Attending art fairs, exhibitions, or joining art-focused groups can also help you connect with these professionals. Using platforms that compile expert reviews can help streamline your vetting process. This ensures each piece of art resonates with your personal taste and stands as a sound financial choice.

Watch this video to learn more about the risks involved in art investments.

Your Top Questions About Art Investment Risks Answered!

What is the meaning of understanding the risks of art investments?

Understanding the risks of art investments means knowing the potential hazards and uncertainties in the art market. It also involves considering what to think about before investing in art and making informed decisions about whether to invest in a specific artwork.

What are some risks associated with art investments?

Common risks associated with art investments include fluctuations in market demand, issues with authenticity and provenance, the potential for forgeries or counterfeits, and lack of liquidity (how easily you can sell an asset).

How can one determine the risks of investing in a particular artwork?

You can determine the risks of investing in a particular artwork by conducting thorough research on the artist, the piece, and the current state of the art market. Seeking advice from art experts and consulting historical sales data can also provide valuable insights.

Is investing in art a low-risk or high-risk venture?

Investing in art can be both low-risk and high-risk, depending on factors like the artist’s reputation, the current state of the art market, and the rarity of the artwork. Carefully assess the risks before deciding to invest.

Are there any ways to mitigate the risks of art investments?

While no investment is completely risk-free, you can mitigate the risks of art investments by diversifying your portfolio with different types of art. Invest in well-established artists and reputable galleries, and thoroughly research the artwork before making a purchase.

What are some resources for understanding the risks of art investments?

Various resources are available for understanding the risks of art investments, including art market reports, investment guides, and online communities for art investors. Consulting with art advisors and attending seminars can also provide valuable insights.