Understanding the Peer-to-Peer Lending Process

Peer-to-peer lending has revolutionized how you and businesses can access financing, presenting a distinctive alternative to traditional banking.

This model connects you directly with investors, eliminating the middleman and often resulting in more favorable terms for both sides.

You ll explore the concept of peer-to-peer lending, delving into its step-by-step workings and the benefits it offers.

You will examine potential risks and learn how to navigate them effectively. You will also get guidance on selecting the right platform to meet your specific needs.

Get ready to dive into this exciting financial world!

Contents

- Key Takeaways:

- What is Peer-to-Peer Lending?

- How Peer-to-Peer Lending Works

- Benefits of Peer-to-Peer Lending

- Risks and Considerations

- Choosing a Peer-to-Peer Lending Platform

- Frequently Asked Questions

- What is peer-to-peer lending?

- How does peer-to-peer lending work?

- What are the benefits of peer-to-peer lending?

- What are the risks of peer-to-peer lending?

- What are the requirements for participating in peer-to-peer lending?

- Is peer-to-peer lending regulated?

Key Takeaways:

Peer-to-Peer lending lets individuals borrow and lend money without banks in the way. Borrowers submit requests, and investors choose which loans to help fund. Enjoy lower rates and better returns, but remember: there are risks to weigh too!

What is Peer-to-Peer Lending?

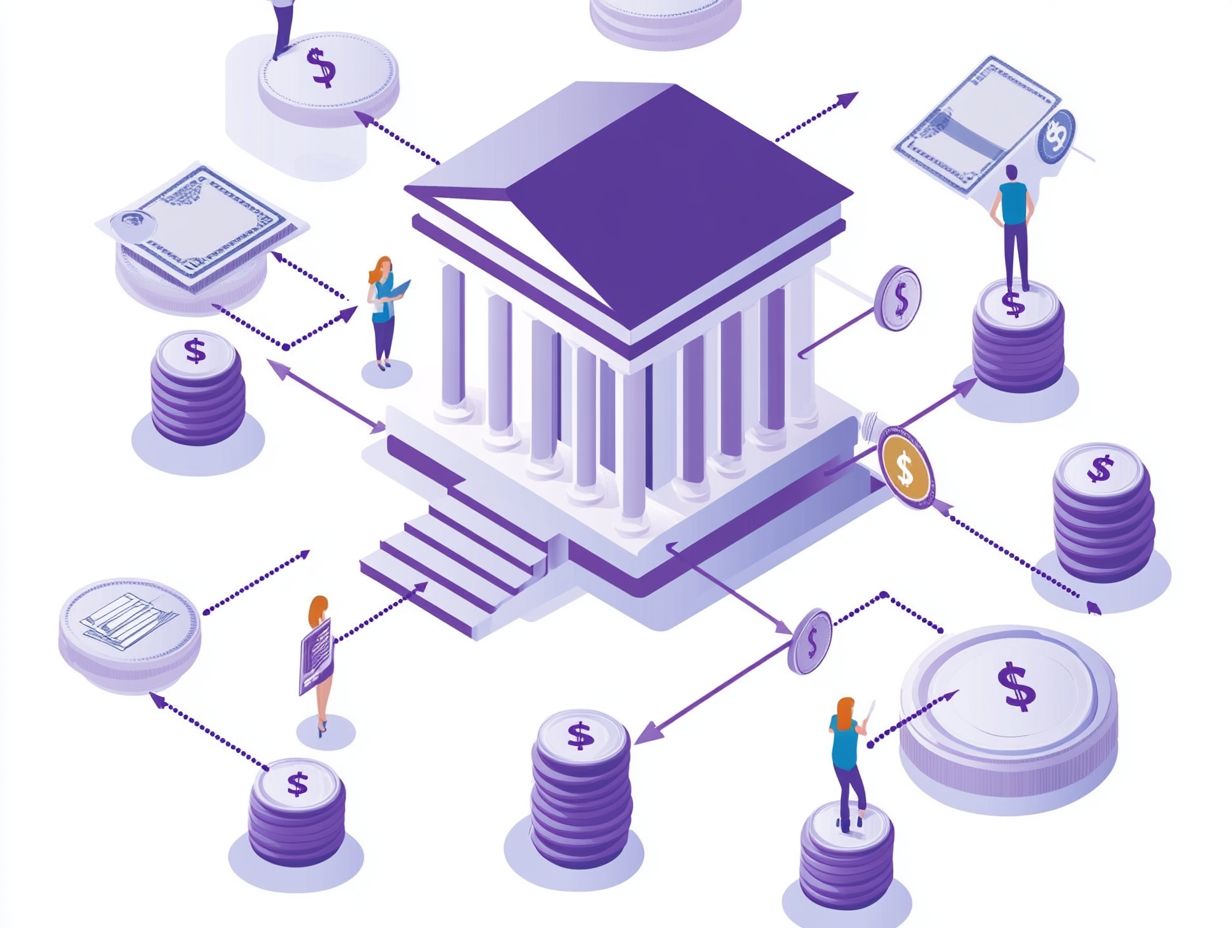

Peer-to-peer lending, commonly known as P2P lending, represents a transformative approach that seamlessly connects you, the borrower, with individual investors via online platforms.

By sidestepping traditional financial institutions, this innovative model has significantly evolved over the years. It s reshaping how personal and business loans are accessed, offering you greater flexibility and accessibility than ever before.

Defining the Concept and Its Evolution

The concept of peer-to-peer lending, often referred to as social lending or crowdfunding, has transformed from informal lending practices into well-structured online platforms that facilitate loan applications between borrowers and investors.

Gone are the days when individuals depended solely on their personal networks to secure loans. With technological advancements, this practice has seen a remarkable evolution.

Online platforms have made access to credit more accessible, enabling borrowers with diverse credit profiles to explore financing options that traditional banking often overlooks. These platforms typically use advanced computer programs to evaluate your credit profile, which is a record of your borrowing and repayment history.

This shift has not only created opportunities for millions in need of funds but has also posed a challenge to traditional financial institutions. They are now prompted to innovate and adapt in a landscape where direct lending between individuals is increasingly embraced and recognized as beneficial.

How Peer-to-Peer Lending Works

To truly grasp how peer-to-peer lending operates, you must delve into the intricate step-by-step process that links borrowers with investors, including understanding the role of intermediaries in peer lending.

It starts with loan applications and moves through the careful evaluation of borrower creditworthiness and a thorough risk assessment.

Understanding these elements will enable you to navigate the world of peer-to-peer lending with confidence.

Step-by-Step Process

The step-by-step journey of P2P lending begins with you, the borrower, submitting your loan requests on online platforms where potential investors will assess your profile and learn about what to expect from peer-to-peer lending returns.

Once your loan request is in, the platform meticulously crafts a detailed borrower profile for you. This profile includes your financial history, credit scores, and personal background information. It s essential, as it enables potential investors to evaluate the risk involved in lending to you.

Afterward, your loan listing comes to life, showcasing your request alongside key details like the loan amount, interest rate, and purpose of the loan. Investors can then peruse these listings, filtering based on their own investment preferences and risk tolerance levels.

This process enables them to make informed decisions about which loans to fund, aligning with their individual strategies. This level of transparency cultivates a dynamic marketplace where you and the investors can engage effectively.

Ready to dive into peer-to-peer lending? Start exploring your options today!

Benefits of Peer-to-Peer Lending

Peer-to-peer lending presents a wealth of advantages for you as both a borrower and an investor. With access to a variety of loan options, you can choose what fits your needs best.

You can also enjoy competitive rates often available in this space, leading to substantial savings. The potential for higher returns on your investment makes peer-to-peer lending a compelling alternative to traditional lending methods.

Advantages for Borrowers and Investors

The advantages of P2P lending for you as a borrower are clear: you gain access to personal loans with lower interest rates. Investors, on the other hand, enjoy potential returns that outshine traditional savings accounts.

This innovative lending model reduces the administrative fees that often burden conventional financial institutions. It also provides flexible loan options tailored to your unique needs.

Imagine needing funds for home repairs. With P2P lending, you can quickly secure a personal loan at an attractive interest rate often significantly lower than what traditional banks would offer!

Investors have the opportunity to earn higher returns, occasionally exceeding stock market yields. This makes P2P lending an enticing option for diversifying their portfolios.

With such competitive rates and adaptable terms, it s no wonder P2P lending is becoming an increasingly attractive choice in today s financial landscape.

Risks and Considerations

While peer-to-peer lending offers enticing opportunities, it’s essential for you to grasp the associated risks and considerations. Pay particular attention to the potential for loan defaults and the risk management strategies that can help you mitigate possible losses.

Potential Risks and How to Mitigate Them

Potential risks in P2P lending, such as defaults and questions about a borrower’s ability to repay loans, can be effectively managed through a careful examination of financial information and a clear understanding of transaction costs.

To solidify this strategy, it s essential for you to conduct comprehensive borrower assessments. This means diving into credit scores, evaluating income stability, and reviewing past borrowing behavior.

By doing this, you can create a more accurate picture of a borrower’s ability to repay. Grasping the transaction costs tied to each loan enables you to make well-informed decisions about profitability and risks, helping you assess your overall portfolio risk more effectively.

Implementing these strategies not only contributes to more dependable lending practices but also bolsters the sustainability of the P2P lending ecosystem as a whole.

Choosing a Peer-to-Peer Lending Platform

When selecting the ideal peer-to-peer lending platform, it’s crucial for you to consider a variety of factors. Pay attention to the reputation of the lending platforms, the range of loan options, and the competitive rates available to both borrowers and investors.

Each of these elements plays a significant role in ensuring you make an informed and beneficial choice.

Factors to Consider and Comparison of Top Platforms

When you re selecting a P2P lending platform, it’s crucial to weigh factors like administrative fees, investor protections, and the range of loan amounts tailored to various borrower needs.

Evaluating these elements can greatly influence both borrowers and investors. Higher fees might scare off potential loan seekers, while strong borrower protections can build trust in the lending experience.

For example, Platform A might have lower setup costs than Platform B, making it the go-to choice for those seeking smaller personal loans. On the other hand, Platform C s flexible loan offerings cater to everything from home improvement to debt consolidation, attracting a wider array of customers.

By understanding how these factors interact, you can make a more informed decision that aligns perfectly with your financial goals.

Frequently Asked Questions

Have questions about peer-to-peer lending? We have answers! Explore the most common queries to make your lending journey smoother.

Start your P2P journey today and find the platform that suits you best!

What is peer-to-peer lending?

Peer-to-peer lending is a borrowing and lending process that connects individuals or businesses in need of a loan with potential lenders through an online platform. This approach removes the role of traditional financial institutions, allowing for direct borrowing and lending between individuals.

How does peer-to-peer lending work?

Peer-to-peer lending platforms match borrowers and lenders based on their specified preferences and requirements. Borrowers fill out an application and, if approved, are connected with multiple potential lenders.

Lenders can then choose which loans they want to fund and earn interest on the amount they lend.

What are the benefits of peer-to-peer lending?

One of the main benefits is that it offers potentially lower interest rates for borrowers compared to traditional loans. It also provides an alternative investment opportunity for lenders, who can earn higher returns than those typically found in traditional savings accounts.

The online platform also makes the process more convenient and efficient for both parties.

What are the risks of peer-to-peer lending?

There s a chance borrowers might not repay their loans, which could lead to unexpected losses for lenders! Additionally, there is no guarantee of repayment, as the loans are not backed by a financial institution.

It s important for lenders to thoroughly research borrowers and diversify their investments to minimize potential risks.

What are the requirements for participating in peer-to-peer lending?

The requirements for participating vary depending on the platform. Generally, borrowers must be at least 18 years old, have a valid bank account, and maintain a good credit score.

Lenders may also need to meet certain criteria, such as being an accredited investor, based on the platform’s rules and regulations.

Is peer-to-peer lending regulated?

In most countries, peer-to-peer lending is regulated by financial authorities to protect both borrowers and lenders. Regulations may vary but typically include guidelines for borrower eligibility, loan terms, and transparency in the lending process.

It s important for participants to research the regulations in their country before getting involved in peer-to-peer lending.