Common Mistakes in Risk Management for Investors

In the realm of investing, grasping the intricacies of risk management is essential for achieving success. This article delves into the core principles of risk management, emphasizing its importance in reducing losses while optimizing returns.

You ll encounter common pitfalls that investors often face and discover how emotional biases can obscure sound judgment. We will thoroughly examine effective strategies for mitigating risks.

By the conclusion, you will possess the insights needed to make informed decisions and elevate your investment strategy. Dive into this article to uncover vital insights for your investment journey!

Contents

- Key Takeaways:

- Understanding Risk Management for Investors

- Importance of Risk Management for Investors

- Common Mistakes in Risk Management

- Identifying and Avoiding Pitfalls

- Overcoming Emotional Biases in Risk Management

- Effective Strategies for Risk Management

- Frequently Asked Questions

- What are some common mistakes to avoid in risk management for investors?

- How important is diversification in risk management for investors?

- What is the role of risk tolerance in risk management for investors?

- Why is having a long-term investment strategy important in risk management for investors?

- How can emotions impact risk management for investors?

- What are some risk management strategies for investors?

Key Takeaways:

Effective risk management is crucial for investors to minimize losses and maximize returns. Emotional biases can negatively impact risk management decisions, so it’s important to identify and overcome them. To enhance your understanding, consider exploring common mistakes in collectible investing. There are proven strategies and techniques that investors can utilize to effectively mitigate risk in their investments.

Understanding Risk Management for Investors

Understanding risk management as an investor means recognizing its vital importance in navigating today s intricate financial landscape, especially with unpredictable market fluctuations stemming from events like the pandemic, compliance failures, and cybersecurity threats.

This ongoing process empowers you to identify risks. You can also evaluate their potential impacts and implement effective strategies.

By concentrating on your strategic objectives and maintaining a diversified investment portfolio, you can align your risk management practices with your long-term growth ambitions, all while steering clear of the emotional pitfalls that can cloud your investment decisions.

What is Risk Management?

Risk management involves a systematic approach to identifying, assessing, and mitigating risks that could hurt your financial goals and investments. This process is essential for any investor aiming to navigate market uncertainties with confidence.

At its core, risk management includes several critical components. One of these is risk assessment, where you evaluate potential threats to your assets. It also requires the identification of various risk factors, such as economic fluctuations or regulatory changes.

Compliance risks arise from not adhering to laws and regulations, impacting your investment strategies. This can potentially result in hefty penalties or damage to your reputation.

Imagine a fund manager facing new financial regulations; any oversight in compliance could jeopardize their operations and alter the market’s perception. This, in turn, could influence investor confidence and ultimately affect portfolio performance.

Importance of Risk Management for Investors

The significance of risk management for you as an investor cannot be overstated; it stands as a cornerstone in minimizing losses and maximizing returns.

Implementing effective risk management strategies ensures your investment goals align with your long-term financial growth aspirations.

Minimizing Losses and Maximizing Returns

Minimizing losses and maximizing returns are among your primary objectives in effective risk management. This drives you to adopt robust investment strategies and portfolio management techniques that align with your risk tolerance.

To achieve these goals, consider diversifying your asset classes. This approach helps spread risk across various investments. By allocating your resources across equities, bonds, and alternative assets, you can ensure that a downturn in one area doesn t significantly impact your overall portfolio.

Incorporating regular rebalancing allows you to adjust based on market conditions and performance, keeping your investment strategy in sync with your goals. By utilizing advanced tools like scenario analysis, which means looking at different possible outcomes to see how they might affect your investments, you can enhance your decision-making.

Common Mistakes in Risk Management

Many investors make common mistakes by not assessing risks properly. This can lead to emotional decisions that jeopardize their financial goals, highlighting the importance of understanding risk management in investments.

Identifying and Avoiding Pitfalls

Identifying risks and steering clear of pitfalls are crucial elements of effective risk management, empowering you to make informed investment decisions while minimizing the emotional rollercoaster that can derail your strategies.

Use practical methods like analyzing market trends and historical performance. Diversification strategies help you navigate the investment landscape with renewed confidence.

Clear communication about risks helps you understand the implications of your choices, fostering transparency in your decision-making processes.

This level of understanding sharpens your rationality in making investment choices and helps you build a resilient portfolio capable of withstanding market fluctuations.

Regularly revisiting and reassessing these risks ensures that you remain adaptable to ever-changing market conditions.

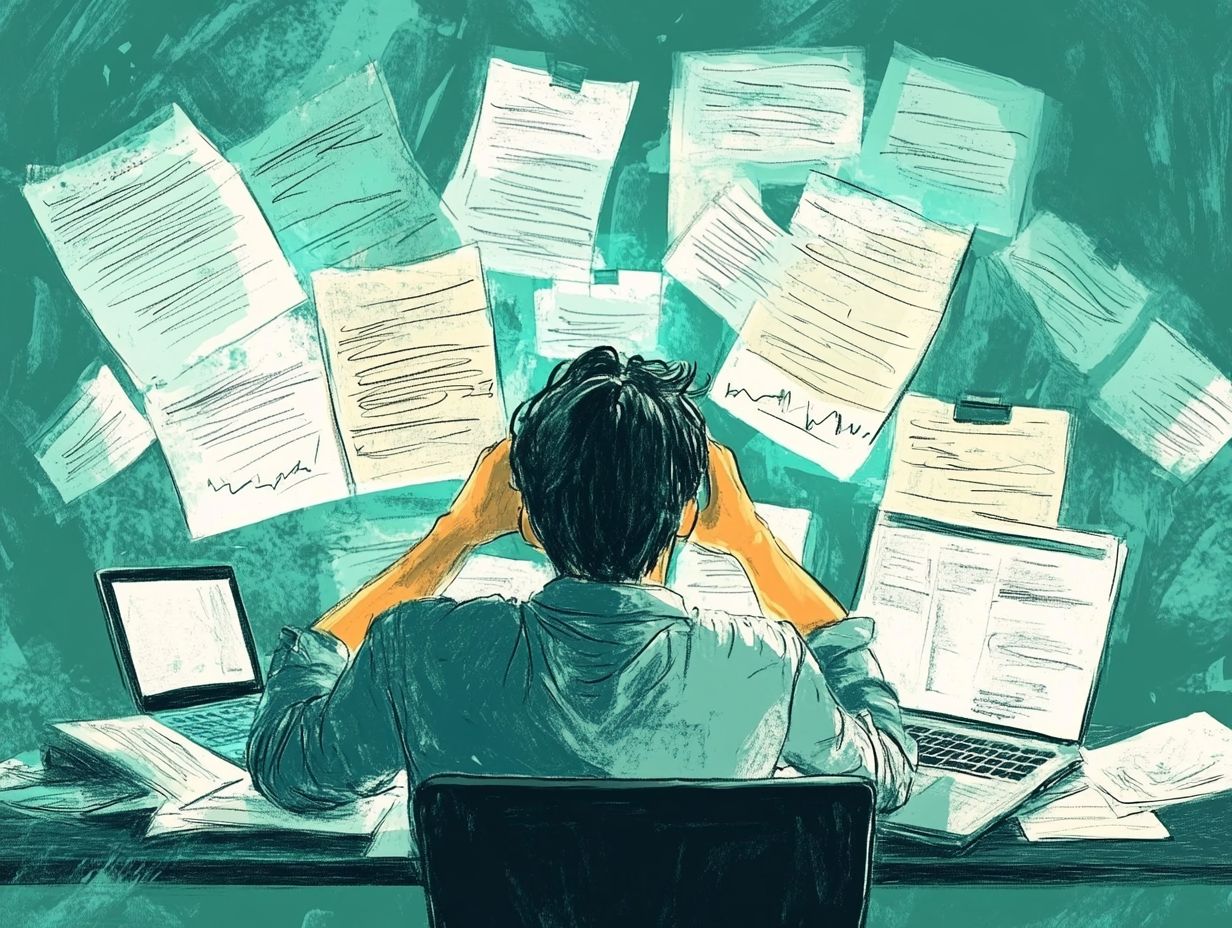

Overcoming Emotional Biases in Risk Management

Overcoming emotional biases in risk management is essential for making sound investment decisions and cultivating long-term financial growth.

These biases can easily cloud your judgment, leading to flawed risk assessments that may hinder your financial success. By addressing and mitigating these biases, you position yourself to navigate the complexities of investment with clarity and precision.

How Emotions Affect Risk Management Decisions

Your emotions can significantly influence your investment choices, often driving impulsive behaviors like emotional investing, which can lead to subpar strategies and heightened financial risks.

When you feel fear, it’s not uncommon to panic and sell off assets at the worst possible moments, locking in losses instead of patiently waiting for a market rebound.

Conversely, during bullish trends, the tempting prospect of potential profits can ignite overwhelming greed, prompting you to make overly aggressive bets without conducting thorough analyses.

This emotional rollercoaster skews your perception of market conditions and clouds your judgment, making it increasingly difficult to stick to a disciplined investment plan.

Such reactions can result in inconsistent outcomes, ultimately undermining your long-term success in the ever-fluctuating market landscape.

Effective Strategies for Risk Management

Implementing effective risk management strategies is crucial for you as an investor aiming to enhance portfolio growth while navigating the choppy waters of market volatility and investment uncertainties.

By prioritizing these strategies, you can safeguard your investments and position yourself for lasting success.

Proven Techniques for Mitigating Risk

Proven techniques for mitigating risk involve employing robust investment strategies that take into account various risk factors, optimizing the overall performance of your investment portfolio and maximizing your financial returns.

You can adopt comprehensive risk assessment frameworks to identify potential vulnerabilities in your portfolio, such as value-at-risk (VaR), a method that estimates how much a portfolio might lose, given normal market conditions, over a set time period, or scenario testing.

These methods help you understand how different economic conditions may impact asset performance. By complementing these frameworks with meticulous investment research strategies, like fundamental analysis or technical analysis, you can make informed decisions grounded in historical and projected data.

Diversifying your investments across uncorrelated assets further shields your portfolio from market volatility, ultimately fostering a more resilient financial approach that aims for sustainable growth.

Frequently Asked Questions

What are some common mistakes to avoid in risk management for investors?

Some common mistakes to avoid in risk management for investors include not diversifying their portfolio, not having a long-term investment strategy, and not considering their risk tolerance. It’s important to follow essential risk management tips for new investors to enhance your investment approach.

How important is diversification in risk management for investors?

Diversification is crucial in risk management for investors as it helps to spread out their investments across different assets, reducing the overall risk of their portfolio.

What is the role of risk tolerance in risk management for investors?

Risk tolerance refers to how much market fluctuation a person can handle. It’s important for investors because it helps them choose investment options that match their comfort level.

Why is having a long-term investment strategy important in risk management for investors?

A long-term investment strategy helps investors withstand short-term market ups and downs. It minimizes the negative effects of these fluctuations and leads to steadier returns over time.

How can emotions impact risk management for investors?

Emotions like fear and greed can lead to hasty decisions. Sticking to a solid investment strategy is crucial. Don’t let emotions lead you astray!

What are some risk management strategies for investors?

Effective risk management strategies include diversification and setting clear investment goals. Regularly reviewing your portfolio and staying disciplined are key to avoiding emotional decisions.